INTRODUCTION

In the landscape of growth equity, GP Stakes strategies have gained significant traction. Since 2010, the allure of investing growth equity in private capital asset managers has seen a notable rise, a trend paralleling the uptick in private capital commitments from global institutions and ultra-high-net-worth individuals. But what sets GP Stakes apart in the realm of growth equity strategies?

UNIQUE INVESTMENT FEATURES

GP Stakes stand out due to their distinctive approach. Unlike typical growth equity strategies that predominantly yield returns through capital appreciation, GP Stakes strategies often aim for consistent income distributions over time. This approach requires patience, as return on investment does not come from quick flips; instead, it’s a gradual build through income — a result of holding minority stakes in private capital firms and fostering their growth.

UNIQUE INVESTMENT FEATURES

Investors in GP Stakes usually acquire a 15% to 30% share, a sweet spot that allows significant influence without full exposure. With these minority stakes comes essential safeguards like minority shareholder protections, which serves to align interests and mitigate risks. These strategies are not only about the financial stake but also about a partnership that guides the asset manager towards higher growth.

DIVERSIFICATION AND EXPOSURE

A single investment in a GP Stakes fund can offer a window to a network of private capital strategies, geographies, and companies. A portfolio of 15-20 GP stakes could have economic exposure to multiple private capital strategies, multiple geographies, dozens of funds, and thousands of underlying private companies. This is particularly attractive for investors starting to venture into private capital markets or those looking to anchor their portfolios with diversified, core positions.

THE ECOSYSTEM’S EVOLUTION

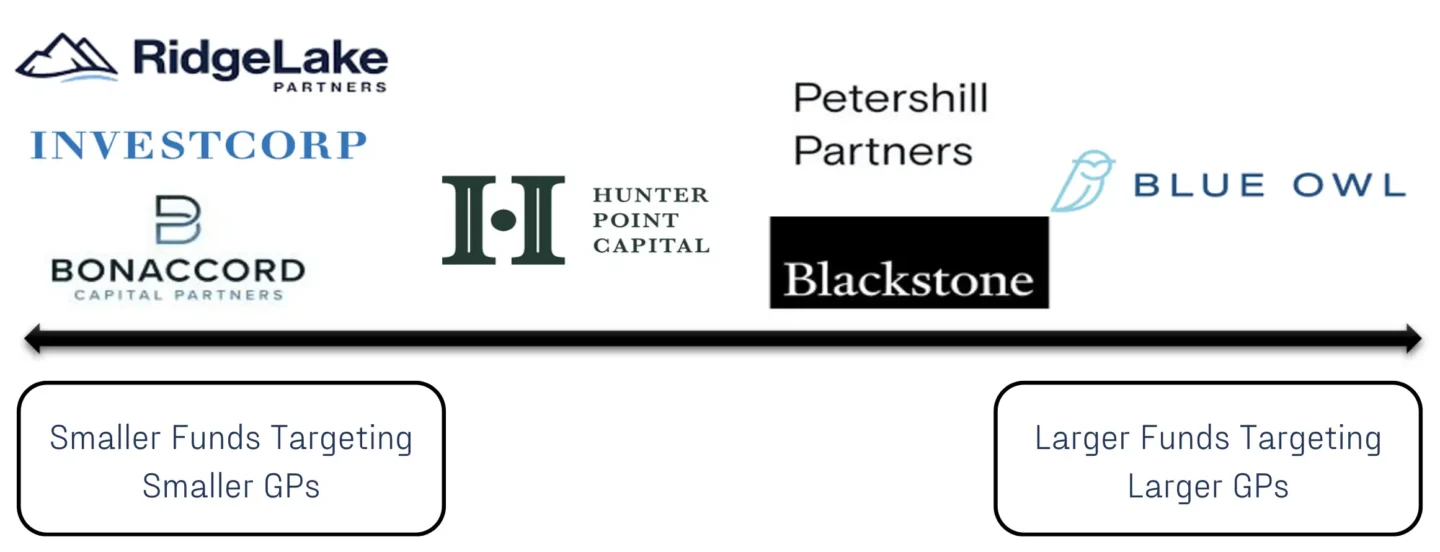

Tracing its origins to specialized deals by institutional investors, the GP Stakes ecosystem has evolved considerably. With the advent of the Petershill Fund I in 2007 by Goldman Sachs and the establishment of Dyal Capital Partners by Neuberger Berman in 2010, the landscape has changed. These entities, initially focusing on different sectors, have now converged on the private capital GP market, creating a dynamic investment environment

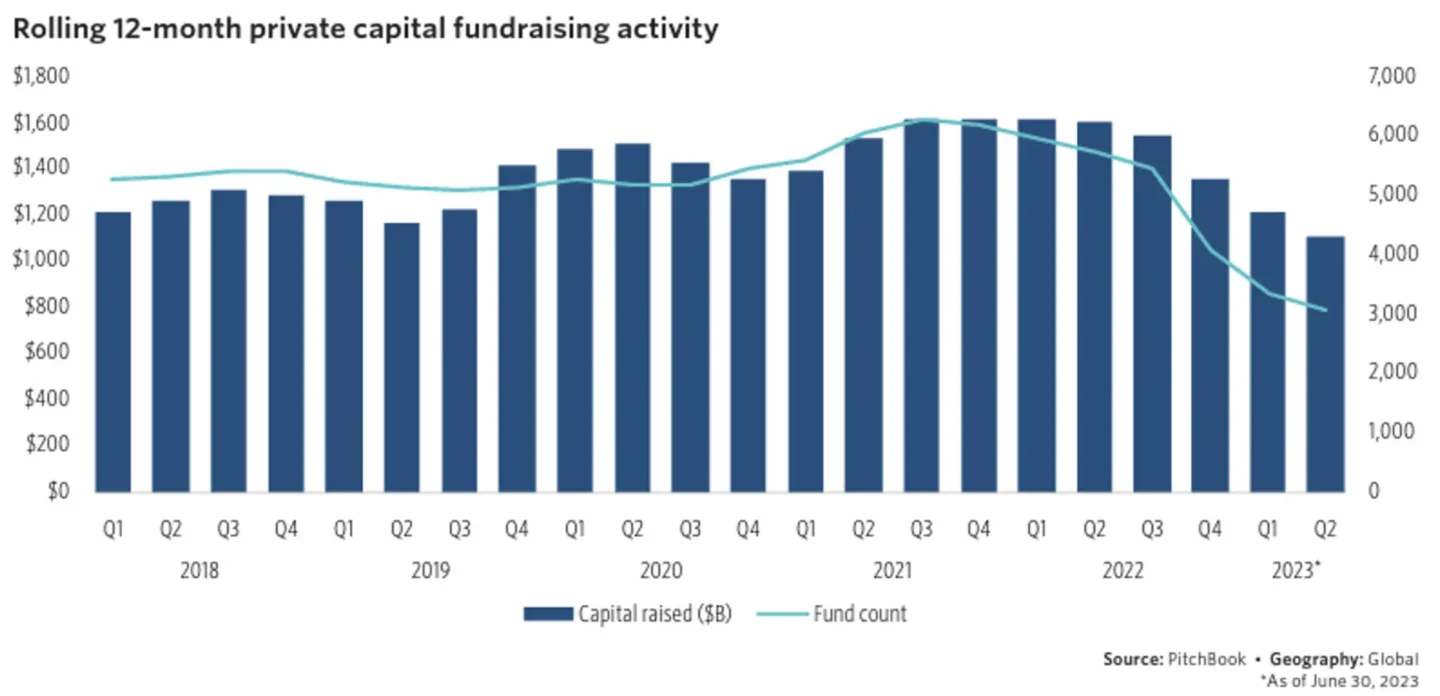

Data from Preqin suggests aggregate commitments to GP stakes strategies is in the $60B to $70B range. Annual commitments can have a range from around $5B up to $20B based on when larger funds are raising capital. The growth of GP stakes has been under pinned with the expansion of private capital AUM. Going forward, GPs may have to shift their growth channels due signs of institutional investor saturation and higher rates making cash and traditional fixed income more compelling.

THE ESSENCE OF RETURNS

GP Stakes funds boast three primary return streams: management fees, incentive fees, and the GPs’ own balance sheet investments in the funds they manage. Each carries its own level of stability and risk, influencing how they are valued:

1. Management Fees are the most stable earnings stream of GPs and are typically capitalized at a materially higher multiple by GP stakes investors. The underlying drivers are the fee-paying assets under management, the effective management fee, and estimates for future fund raises and fee rates. A single fund can provide a steady stream of management income for 10 years or longer.

Based on Goldman Sachs Research on target price methodology for publicly traded private capital managers, fee related earnings (FRE) are valued at the highest multiple given the visibility of long-term contracted cash flows. GS applies a multiple ranging from 13 to 30 with an average of 22. Firms with the highest proportion of FRE typically trade at higher valuations. GP stakes investors are likely to pay a higher multiple on FRE for larger, diversified GPs that have a higher proportion of FRE coming from perpetual funds. Smaller, less diversified GPs are likely to receive a lower multiple on FRE. However, if GP stakes investors can assist in growing a smaller GP into a larger more diversified GP, then there is a potential to receive a higher multiple at exit.

2. Incentive Fees can be lucrative and are based on the performance of underlying funds. Cash flows from incentive fees can be episodic and more challenging to forecast in both timing and quantity. Given these attributes, GS values incentive fee related earnings for covered public GPs at a multiple ranging from 7 to 13 with an average of 8. More diversified GPs with multiple underlying strategies are likely to receive a higher multiple as incentive fee cash flows will have less variance.

3. Balance Sheet Investments from the GP into its managed funds are typically required by investors to better align interests. At a minimum, the GP is typically required to commit 1% with some GPs committing over 5% to each fund. Minority owners in the GP are entitled to a pro-rata share of the total gains of GP co-investments typically on a no-fee, no-carry basis. Cash flows from GP co-investments are episodic and less certain and typically receive a lower multiple compared to FRE. GS models GP co-investments at net asset value. Given current accounting rules, GPs are required to mark balance sheet investments at fair value on a quarterly basis.

OPERATIONAL ENHANCEMENTS AND STRATEGIC GROWTH

Larger GP stakes investors don’t just provide capital; they bring expertise. Entities like Blue Owl and Petershill offer extensive support, ranging from expanding product offerings and distribution channels to improving operational efficiencies and implementing ESG and DEI initiatives. This operational assistance is a critical element, often enhancing the value of the investment beyond mere capital infusion.

PURPOSE OF CAPITAL AND STRUCTURAL PROTECTIONS

Like other growth strategies, GPs seek to raise capital to grow their business. Returns on invested capital for GPs can be highly attractive leading to a greater willingness to raise capital. A common private equity fund term structure is a GP investing 1% of commitments and receiving 20% of total gains if investors receive a preferred return of 8% annualized. If the GP can fulfill the incentive fee mandate, the return on the GP’s commitment of 1% can be high.

Capital can also be used for M&A or lift-outs to expand in different strategies or geographies. Back and middle office functions may need to be enhanced with higher growth. In some instances, partners at GPs are seeking liquidity to diversify their wealth. Growth capital can also facilitate succession plans and the expansion of the ownership base to key employees. GP stakes investors focus on potential alignment issues when key partners are seeking liquidity and will frequently put in structural protections. Common protections that minority investors seek are:

- Restrictions on use of proceeds, which typically entail a certain amount being reinvested in the business

- Consent rights over distributions outside agreement at transaction

- Anti-dilution provisions

- Restrictions on related party transactions

- Consent rights on material changes to capital structure

- Consent rights on material changes to terms of employment for key professionals

- Information rights

- Non-compete agreements for selling partners and key employees

- Seats or observer rights on the Board of Directors

RISKS

As with most private capital strategies the primary risk is underlying portfolio companies materially underperforming expectations for growth and profitability GP Stakes investors must stay vigilant about factors such as fundraising capabilities, fee structures, and market competition. Higher interest rates can create a cross current of headwinds and tailwinds. Higher rates can be a tailwind to private credit managers but a headwind to buyout managers. The composition of higher rates across real rates and inflation can affect strategies differently. It is likely that higher interest rates are a net headwind as traditional asset classes, like cash and fixed income, are more competitive.

LIQUIDITY

An important consideration for investors is liquidity options and expected hold periods. Many GP stakes funds are perpetual but have either provided liquidity or established liquidity plans for LPs. It is common for GP stakes funds to distribute income on a quarterly basis. While the market for minority GP stakes is materially smaller compared to other growth equity strategies, there has been material growth and development.

After many of the early public private capital asset managers converted to corporations from limited partnerships in 2018 and 2019, valuation multiples increased materially as the investor base expanded. Indexes are typically restricted from holding limited partnerships as tax reporting is conducted via a schedule K-1. With higher valuations, going public has become more attractive for larger, diversified private capital managers. Petershill combined several private funds in an IPO of a portfolio of minority stakes. With the stability of underlying cash flows, some GP stakes managers have been able to issue securitizations, which hastens the return of capital to investors. GP stakes funds have used credit facilities at the fund level to finance acquisitions, lowering the required capital calls from LPs. Other liquidity options can include M&A, selling to strategic investors, GPs buying back equity interests, continuation funds, or other secondary market transactions.

TAX CONSIDERATIONS

There can be considerable complexity in the drivers of and nature of annual taxable income. GP stakes funds can also require investors to file an abundance of tax forms when state taxes are considered. GP stakes funds that cater to US taxable investors are typically structured as limited partnerships, which report tax information via a Schedule K-1. It is not uncommon for some GP stakes funds to also issue 30 or more state K-1s driven by activities of underlying portfolio companies of the GPs. For taxable investors this can create a complicated and costly tax filing process. Generally, GP stakes funds distribute gross income that is a varying blend of ordinary income, interest income, ordinary dividends, qualified dividends, short-term capital gains, and long-term capital gains from a tax perspective. Transaction structuring impacts the level and timing of deductions. Material deductions can occur from certain expenses and Section 743 adjustments, which can provide optionality on adjusting the tax basis for each the seller and buyer. In instances where 743 adjustments lead to deductions for the GP stakes investor, a material portion of taxable income can be deferred. It is critical that investors understand potential tax ramifications given their specific tax circumstances.

GLASFUNDS: SIMPLIFYING GP STAKES INVESTMENT

GLASfunds has extensive experience in evaluating and facilitating investments in GP stakes strategies. We have experience with five GP stakes managers and multiple funds across the size spectrum. GLASfunds provides efficiencies for wealth managers who invest clients in GP stakes funds including providing an aggregate Federal K-1 and the ability for advisors to have their clients file state taxes in a composite filing via GLASfunds’ tax partner. Filing state taxes in a composite filing offers the potential to materially reduce the administrative burden of filing taxes in a multitude of states. To learn more about current opportunities and how GLASfunds can provide efficiencies to GP stakes investing, please contact us at GLASfunds.com.

DISCLAIMER

This report and the information contained herein is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. This information is for discussion purposes only. Nothing contained in this report constitutes tax nor legal advice. Alternative Investing is complex and speculative; and thus, not suitable for all investors. Such investment vehicles contain a high degree of risk and therefore no assurance may be made that any alternative investment objectives will be attained nor that investors will receive return of capital.

This report is an opinion only; it is not to be relied upon as the basis for an investment. Any data and firm information shown are for illustrative purposes. The information in this report has been provided to GLASfunds, including its employees, by sources determined to be reliable in providing such information. Therefore, GLASfunds has not, and is unable to, independently review, prepare, or verify information contained herein; further, GLASfunds makes no representation or warranty regarding the accuracy of the information provided to GLASfunds.Past performance is not indicative of future returns.

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.