Camden Gerard, CAIA

Current Traditional Secondaries Market Overview

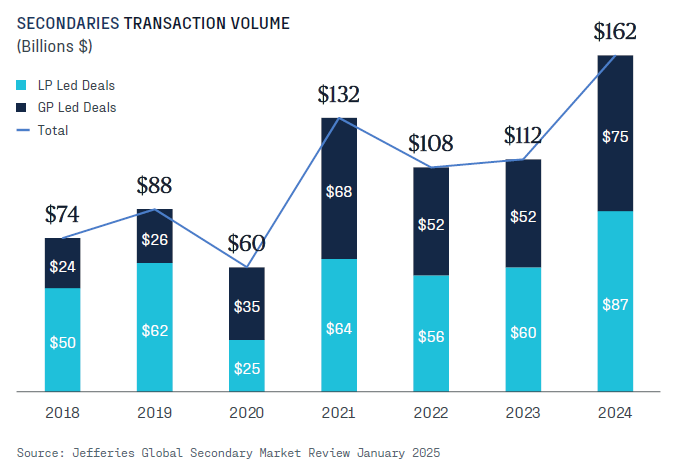

The secondaries market has continued to grow, mirroring the growth in private equity fundraising and deployment. According to data from Jefferies, $162B worth of secondary transactions were executed in 2024 surpassing the previous record of $132B in 2021.(1) This was driven by both LP-led and GP-led deals. Increases in LP-led deal volume was driven by LP liquidity needs. Increases in GP-led deal volume were driven by managers’ demand for continuation vehicles to have more time to accrete value and realize investments. Continuation vehicles also allow existing investors the choice of liquidity or continued exposure.

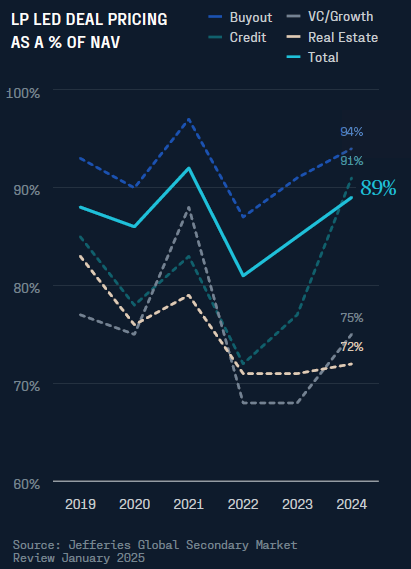

Direct lending was once a niche strategy that delivered outsized risk-adjusted returns, but its popularity has led to an LP secondary transaction pricing has continued to increase over the past few years, reaching an average price of 89% of NAV for buyout, credit, venture/ growth, and real estate, according to data from Jefferies. This increase has been driven by several factors including public market performance, stable interest rates, private capital performance, dry powder, and the supply of secondary related capital. Secondaries managers must increasingly rely on growth and capital efficiency to achieve underwriting targets.

Another potential headwind for traditional secondaries is a slowdown in DPI generation. Utilizing data from Hamilton Lane’s Cobalt, we have found that secondaries managers’ DPI generation has consistently decreased over the last decade or so. Specifically, we analyzed managers’ DPI at the five-year mark of the fund’s life by vintage year and observed that the median DPI has dropped from 0.73x in 2010 vintage funds to 0.37x in 2020 vintage funds.(2) Historically, secondaries funds that have been investing for 5 years have been able to return at least half of commitments to LPs by end of Year 5.(3)

One of the key reasons for allocating to secondaries strategies is J-curve mitigation or quicker distributions compared to other private equity strategies such as buyout. We believe slower distributions are partially a symptom of higher competition in the space and lower realization activity across buyout. Other areas of the secondaries market have a more favorable competitive balance for investors in our view.

Tail-End Secondaries

Tail-end secondaries managers focus on private equity interests in older funds that are typically at least 10 years old and have limited NAV outstanding compared to original commitments. Conversely traditional secondaries managers focus on funds that are three to six years old. We have identified several trends within the asset class worth exploring further:

Less Competition

One significant advantage of tail-end secondaries is less competition. Less managers focus on this area of the market because these older assets could be viewed by some as lower quality and harder to exit, since they have not yet been realized after a notable amount of time.

Robust Underwriting Process

An additional barrier to entry for tail-end secondaries is a robust and sophisticated underwriting process. To generate returns on these older assets, it is imperative for tail-end secondaries managers to be materially effective at sourcing paths to liquidity.

Restrictions on Transfers

Another barrier is greater restrictions on transfers. It is common for tail-end secondaries managers to focus on fund-of-funds and secondaries funds.

Steeper Discounts

Tail-end assets typically transact at materially larger discounts than traditional secondaries. Sellers are willing to accept steeper discounts because the remaining value of these assets is lower compared to the initial commitment and the inherent fixed costs of tracking and monitoring these positions. We have found managers in this space that have been able to achieve consistent purchase price discounts of 30% or more while also generating NAV growth. These discounts help drive more consistent and attractive returns on LP-led deals.

Addressable Market Growth

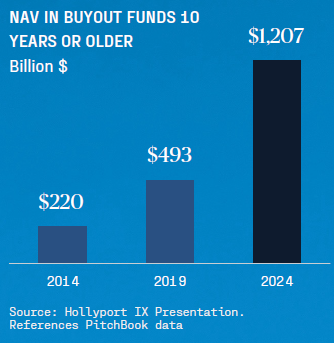

An additional tailwind for tail-end secondaries is the significant growth in the addressable market. The addressable market for tail-end secondaries managers is categorized as the value of private equity funds with vintage years that are at least 10 years old. The number of 10+ year old funds has increased dramatically, mirroring the sharp increase in buyout fund raising activity since the GFC.

According to data from Hollyport and Pitchbook, the addressable market for tail-end secondaries has grown to over $1.2 trillion in 2024, compared to $493 billion in 2019, and $220 billion in 2014.(4)

As the number of legacy private equity funds continues to expand, tail-end secondaries managers will have access to a robust addressable market from which they can source attractive investment opportunities.

Due to the current trends within the broader secondaries market and the inherent advantages of focusing on legacy assets, we believe that tail-end secondaries are an interesting opportunity set within the already attractive private equity secondaries asset class.

Sources

1. Jefferies Global Secondary Market Review January 2025

2. Hamilton Lane / Cobalt

3. PitchBook Capital Pool February 18, 2025

4. Hollyport IX Presentation. References PitchBook data

disclaimer

This report is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. Nothing contained in this report constitutes any tax nor legal advice. This report is solely for the intended recipient, who has warranted qualifications to make sophisticated investment decisions. GLASfunds makes no representations or warranties regarding the methodology used for any investment performance calculations presented by any funds. Past performance is not indicative of future returns.

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.