Brett Hillard, CAIA, CFA, Chief Investment Officer at GLASfunds, & James Ouderkirk, CFA, CPA, Director at GLASfunds

If you are like most advisors, you probably have some nervous clients right now… and some looking for opportunity amidst the carnage.

Markets dipping in and out of correction territory and talk of recession on the President’s lips (among others) can spook even the most unflappable of clients. With the dominance of the “Mag 7” flagging and the outlook for U.S. equities uncertain at best, clients with suitable liquidity are increasingly seeking the relative safety (and often outsized returns) of alternative investments.

At GLASfunds, we work with 150+ wealth management firms and have a unique lens into what advisors are exploring in terms of alternatives that can hedge against public market volatility and potentially provide long-term, attractive returns that are non-correlated with public market risks. Between this network and our own research initiatives, we’ve identified three alternative strategies that we particularly like in the current market environment.

1. Student Housing

America’s colleges and universities are experiencing two distinct and diverging trajectories. Many smaller, less-well-known liberal arts institutions are experiencing a long-term decline in enrollments and are being forced to reckon with cutting programs or consolidating with other schools to survive. But for Tier 1 schools (think the Big 3, the Big Ten, Big 12 and ACC) enrollments are booming alongside demand for new student housing.

Because of their stellar reputations and ubiquitous brand visibility, Tier 1 schools typically have lower acceptance rates. That puts those schools and their administrators in the enviable position of being able to effectively manage total enrollment to keep demand high. Despite student housing having been largely “institutionalized” in real estate investing, many college campuses still have a structural deficit in purpose-built housing near campus.

America’s colleges and universities are experiencing two distinct and diverging trajectories. Many smaller, less-well-known liberal arts institutions are experiencing a long-term decline in enrollments and are being forced to reckon with cutting programs or consolidating with other schools to survive. But for Tier 1 schools (think the Big 3, the Big Ten, Big 12 and ACC) enrollments are booming alongside demand for new student housing.

Because of their stellar reputations and ubiquitous brand visibility, Tier 1 schools typically have lower acceptance rates. That puts those schools and their administrators in the enviable position of being able to effectively manage total enrollment to keep demand high. Despite student housing having been largely “institutionalized” in real estate investing, many college campuses still have a structural deficit in purpose-built housing near campus.

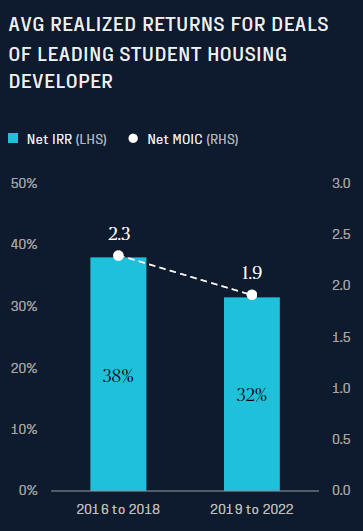

These students typically come from higher-income households, which leads to more stable demand and better pricing for new housing that meets their expectations. While illiquid during the first 3-5 years as housing is built and rented out, the return profile for developing high-demand student housing has historically been in the high teens or greater.

2. Transport Assets

Even amid the disruption to the existing trade balance, transportation assets (think container ships, aircraft, and rail cars) may offer investors consistent returns with downside protection, as total returns are driven by predictable, often contractually obligated, cash flows. The current escalatory tariff environment could even serve as a potential “tailwind” by incentivizing domestic manufacturing and distribution.

Transportation assets are inherently diversified in that they offer exposure to durable hard assets that are critical to supply chains across multiple industries. They may also offer low correlations to public equity markets and other private capital strategies, including private equity, private debt, and real assets.

In addition, transportation assets can provide inflation protection. While rail car containers and shipping containers are a critical component of our economy, they represent a small portion of total logistics costs, granting greater pricing power for owners. Rail is becoming a more attractive transport option compared to alternatives like trucking, due to lower prices and efficient transit that is more carbon friendly.

3. Reinsurance

The recent wildfires in southern California represent just the latest in a string of natural disasters that are bolstering the need for reinsurance to keep property owners insured and insurance providers in business.

Insurance companies themselves need insurance to make sure they have enough capital to pay out claims after natural disasters. They also must meet regulatory requirements for sufficient capital reserves, which is where the “reinsurance” market comes in to play.

Essentially, reinsurance companies (such as Swiss Re Group, Munich Re Group, and Berkshire Hathaway) provide insurance to other insurance companies to cover against catastrophic loss. With an estimated $40-$50 billion in insured losses resulting from the California wildfires (estimates by Renaissance Re, Swiss Re, and Arch Capital) and being that those losses occurred so early in the year, insurance companies will need to lean heavily on both repricing of premiums, as well as an injection of capital from the reinsurance marketplace. Hence the opportunity for investors.

The insurance industry has been in a hard market since the end of 2022, which refers to capital being relatively scarce. That need for capital presents an opportunity for investors. Since 2002 through 2024, the Swiss Re Catastrophe Bond Index (catastrophe bonds operate similar to reinsurance) generated an average annualized return of nearly 11.5% during hard markets.

While the potential for attractive returns compared to many traditional public and private investments is compelling, investing in the reinsurance space offers investors another appealing benefit: diversification. While there is of course an inherent risk in investing in the insurance space (i.e. natural disasters) that risk is very different and uncorrelated from the usual market risks that come with investing in the public markets.

Particularly during times of volatility, when traditional financial markets experience downturns, the reinsurance market may not follow the same trends, offering a hedge against those risks. And with the trend toward more frequent and destructive natural disasters showing no signs of abating, investing in the reinsurance market presents investors with an attractive long-term opportunity.

disclaimer

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply any specific level of skill or expertise. This information is intended solely for financial institutions and investment professionals and is not directed at individual consumers or retail investors unless explicitly noted.

The opinions expressed herein are for informational purposes only and should not be construed as specific advice or recommendations regarding any security or advisory service. The content is intended to provide educational insights about the financial industry. The views shared in this commentary are subject to change at any time without notice. Although all information presented, including that from external, linked, or independent sources, is believed to be reliable, we make no guarantee as to its accuracy or completeness. We reserve the right to modify these materials without notice and are under no obligation to provide updates.

This document may contain “forward-looking statements,” identifiable by terms such as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar expressions. Examples include, but are not limited to, projections about financial conditions, operational results, and the performance of investment strategies. These statements are subject to various risks and uncertainties, including, but not limited to, general and local economic conditions, changing competition within specific industries and markets, fluctuations in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory, and technological factors that could cause actual results to differ significantly from those projected.

This report is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. Nothing contained in this report constitutes any tax nor legal advice. This report is solely for the intended recipient, who has warranted qualifications to make sophisticated investment decisions. GLASfunds makes no representations or warranties regarding the methodology used for any investment performance calculations presented by any funds. Past performance is not indicative of future returns.