“Litigation finance is compelling from an outright investment perspective in my view and can lead to favorable societal impact if the right firm is selected”

With inflation breaching 40 year highs and the consensus tripping over themselves to increase the estimates of future Fed hikes, I think it’s important to step back and think about how the Fed will allegedly accomplish tackling inflation.

“At the end of the day rising prices are a function of mismatched supply and/or demand”

Because increasing supply takes time and in many instances is politically challenging, the US relies on the Fed to control inflation. Ultimately, the Fed increases short-term interest rates to increase the costs of durable goods such as housing, autos and other goods that are largely purchased on credit. There are other channels such as sentiment (which is probably the most potent effect) and the wealth effect by raising the opportunity cost of risky assets.

Ultimately, the Fed is trying to decrease demand. Based on history, the ability of the Fed to achieve the often discussed “soft landing” has a slightly higher probability of seeing a rainbow unicorn jump over a pot of gold. The highest probability outcome is the Fed tightening until something breaks. When something breaks, investment will come down, unemployment will go up, demand will decrease and inflation should come down. This is the common playbook that we are all used to.

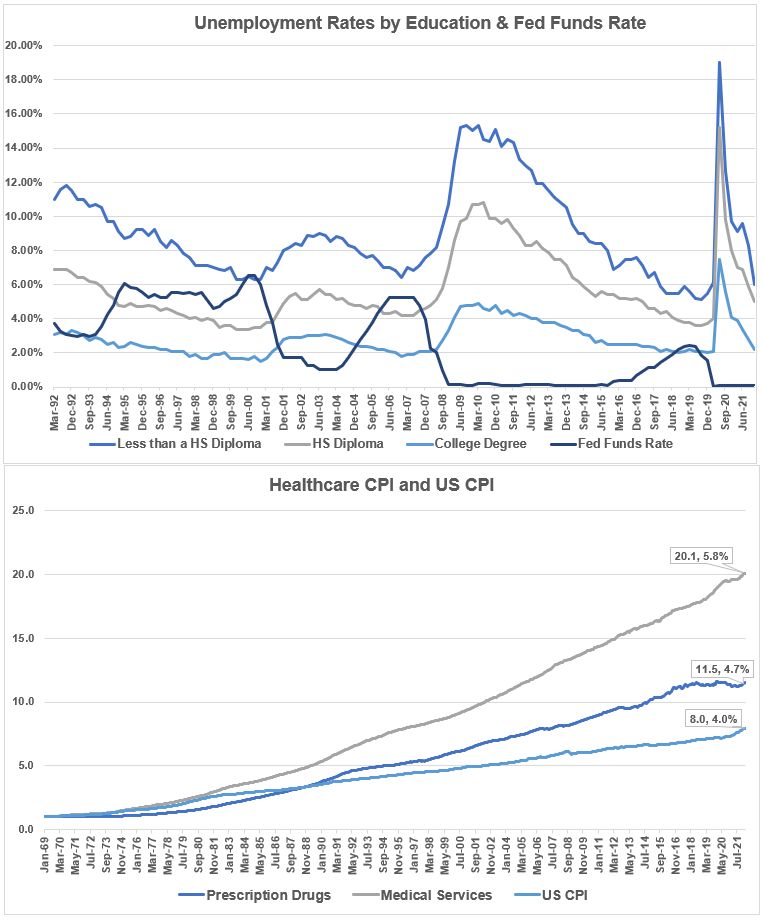

We can also frame this differently. Basically to control inflation, the Fed engineers a recession which disproportionately effects lower skilled workers. Demand is lowered by a greater degree by the lower income deciles so “everyone” can benefit from lower inflation. Is this the best the US can do? Unfortunately in the short-run likely yes. In the intermediate to long-run no. Here are just a handful of cumulative choices the US has made that have ultimately contributed to our present state.

1. Prohibiting one of the largest global purchasers of pharmaceuticals, the US govt, from negotiating prices

2. Allowing healthcare providers and insurers to keep prices opaque

3. Granting anti-trust exemptions to health insurers

4. Prohibitive immigration policies

5. Interest rate subsidies and tax incentives for home owners

6. Zoning laws that prohibit cost effective housing

7. Mass incarceration with a system more focused on deterrence by severity as opposed to rehabilitation

8. Military spending at a rate of nearly the rest of the world combined of which a portion is effectively a subsidy for defense of allies

9. Nearly unlimited higher education financing without demands for accountability by providers

10. Favorable patent protection for pharma and biotech and uncapped pricing power. Some of the higher prices the US pays is a subsidy to allow pharma to sell in countries with price caps. The US is the “release valve”

While I don’t claim to have the answers to these issues, they have contributed to either lower supply or higher demand. A portion of the present state is due to vested interests trying to maintain the status quo.

It’s fair to say nearly all that advocate and craft the Fed raising rates have a college degree or higher. So the ill effects of “lowering demand” will not effect them as much. US healthcare spending is large, has partially driven inflation, and by some broad metrics compares poorly compared to other developed countries in terms of costs compared to broad outcomes. Based on CMS data the US spends nearly 20% of GDP on healthcare. Drug and healthcare services inflation has outpaced broad inflation since 1969 (4.7% annual for drugs, 5.8% for HC services vs. 4% broad CPI). These are likely understated based on how the BLS calculates “constant quality” and “consumer out of pocket services.

A meta study estimates healthcare waste is anywhere from 17% to 50% of annual expenditures. Policies that try to rationalize price and quantity have a chance to move the needle on healthcare driven crowding out and inflation. However, political will has been lacking likely driven by regulatory capture by the industry.

From an investment perspective what are some strategies that can help solve some of these issues while the government remains MIA? Investments in true cost saving technology (there is a lot of “cost reduction washing” in this space so be careful), value based care providers and litigation finance.

Yes that is not a typo….litigation finance! In meetings with funders, there are compelling cases right now that are attacking overt health insurance collusion and anti-trust, collusion among generic drug manufacturers and illicit payments from branded drug companies to generics to keep product off of the market. Additionally, one funder has a strategy of financing a generic producer and the initiative to bust in many instances frivolous patents that protect pricing, not true innovative R&D.

With an estimated $169B in annual healthcare waste due to excessive prices and another $185B in annual outright fraud, healthcare will continue to be a fruitful area for litigation funders. Simply, it’s where the money is.

From a societal perspective it would likely be better if the federal government passed and enforced policy to improve healthcare efficiency then passing the buck to the private law firms. But here we are. Litigation finance is compelling from an outright investment perspective in my view and can lead to favorable societal impact if the right firm is selected.

Clearstead Expands Partnership with GLASfunds to Enhance its ClearAccess Private Markets Investment Platform

Disclosure

This report and the information contained herein is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. This information is for discussion purposes only. Nothing contained in this report constitutes tax nor legal advice. Alternative Investing is complex and speculative; and thus, […]