“It is possible that in the future, historians will look back to late February 2022 as the beginning of the end for the USD’ dominance as the global reserve currency”

In late February, the US, EU and other G7 countries issued sanctions against the Central Bank of Russia, effectively seizing nearly $300 billion of reserves held outside of Russia. The reasoning and rationale of the moves are well known and not the topic of this article. It has been reported that some leaders of major US banks and some senior Fed officials were surprised and against the decision due to future ramifications for the USD. These assets were either directly or functionally invested in high quality (in terms of nominal default risk) sovereign bonds at foreign central banks, intra-national organizations and private banks. These reserves were largely accumulated through the export of various commodities.

“The trade surplus countries who are also not considered top allies of the US and EU have surely taken notice that holding reserves abroad may not be as “risk-free” as once originally thought”

Not even mentioning that holding Treasuries, Bunds, OATs etc. at materially negative real yields is far from ideal, now there is an additional risk. If the US and EU do not approve of a country’s foreign policy (to be clear I am against the Russian invasion the gratuitous loss of life. Respective countries always think their foreign policies are beneficial or they would not pursue them), they can seize reserves that originated through the export of real goods. In this instance the US and EU received free energy, agricultural and other commodities. In essence, now investing in the US financial system comes with a condition that the US must approve of major foreign policy decisions. The parameters of approval could be ever changing as well.

From the perspective of that country, that seems like a bad deal. Higher yields do not compensate for this binary risk. One day Russia had $300 billion of foreign held reserves and now they have $0. What would a yield premium have provided in this situation? While the future has many paths this at least increases the risk that material foreign blocs will look to diversify away from the USD system and perhaps move to a neutral reserve asset. A neutral, commodity related reserve asset is not so far fetched as some may believe. John Maynard Keynes proposed such a concept at the Bretton Woods conference post WWII. His “bancor” idea lost out to the US plan.

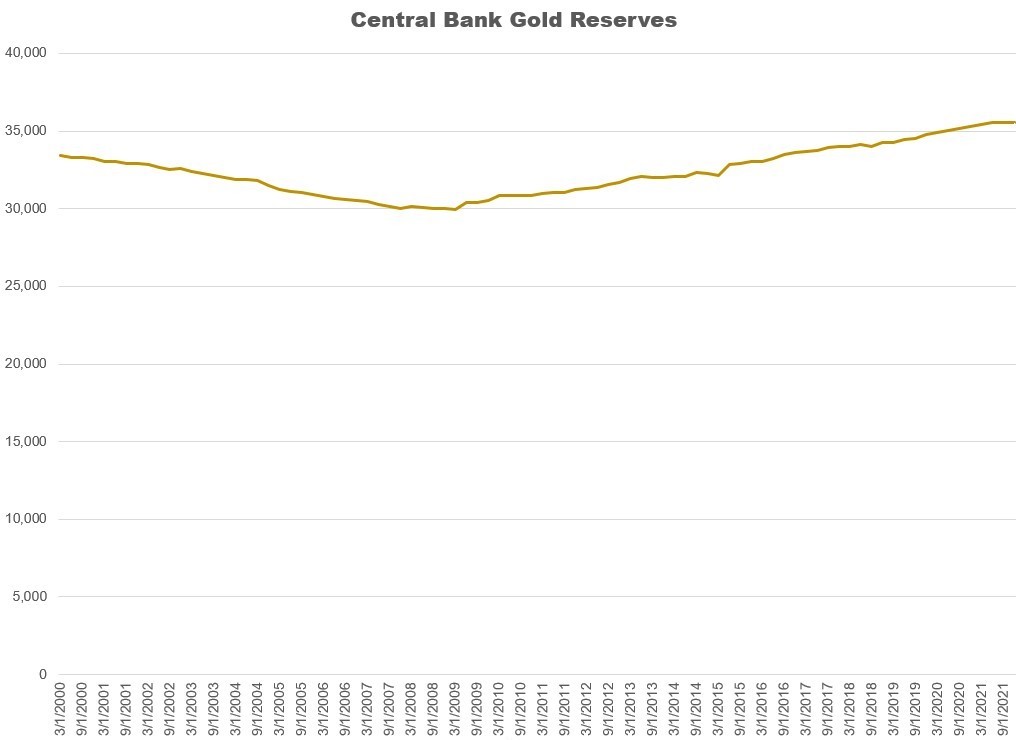

I would argue that this trend has already been occurring since 2008-2009 and could accelerate. Central banks have increased their allocation to gold. Nearly all of the net increase has been from emerging markets with large current account surpluses. The increase is likely understated as well due to sporadic reporting by China. While the USD may be the “cleanest dirty shirt” compared to other developed currencies, it has depreciated materially against commodities and real assets. The US has large twin deficits that may be unsustainable. Additionally, the US has increasingly weaponized the USD with sanctions on Iran, Syria, Venezuela, Afghanistan and Russia. While the USD has increased as measured the DXY this is largely due to the EUR and JPY. The EU and Japan are more susceptible to energy embargoes.

I think investors holding a sensible allocation to gold makes sense in the long-term and especially now given the macro and geopolitical conditions. Unfortunately investing in gold can lead to contentious debates between the maximalists (i.e. the gold bugs) and the minimalists (“it has no intrinsic value and no yield”). I think there is a middle ground….diversification across different functioning assets. For the gold minimalists try to answer these questions: “Why are global central banks increasing gold holdings when gold is arguably the antithesis of fiat free floating FX? Why are the central bankers not trusting their counterparts?”. For the gold bugs, why do you want to avoid transcendent companies like Apple?

To me equities and fixed income work well within regimes and periods of relative stability. Investors want exposure to quality and innovative companies that are feverously working on enhancing productivity or finding the “next big thing”. This is the upside of the human condition. Unfortunately, the human condition has a dark side. People and governments do stupid things (is anyone really going to argue against this one!). When monetary and economic regimes shift, gold can protect purchasing power.

An example is Nixon avoiding pain by either/or cutting fiscal spending and raising rates. Instead he closed the gold window, instituted price controls and then allowed the USD to devalue. Gold shined until Volcker came along and restored credibility. Then it was time for equities to shine. If anyone can reliably and accurately predict these shifts then congratulations you’re well ahead of the competition. Unfortunately, I don’t have such skills so I rely on holding differentiating assets on the long-term.

It is possible that in the future, historians will look back to late February 2022 as the beginning of the end for the USD’ dominance as the global reserve currency. I will reiterate there are multiple paths this could take. However, I will be very surprised if the weaponization of the USD is without consequence. I have heard there is “no alternative.” My answer to that is “for now.” Major shifts can occur gradually then suddenly. Second, losing $300 billion overnight is very extreme. There may not be an alternative that is as good as a non-weaponized USD but the game has changed. It shouldn’t be that hard to find alternatives that can be more favorable then losing 100% of reserves held in the US and EU.

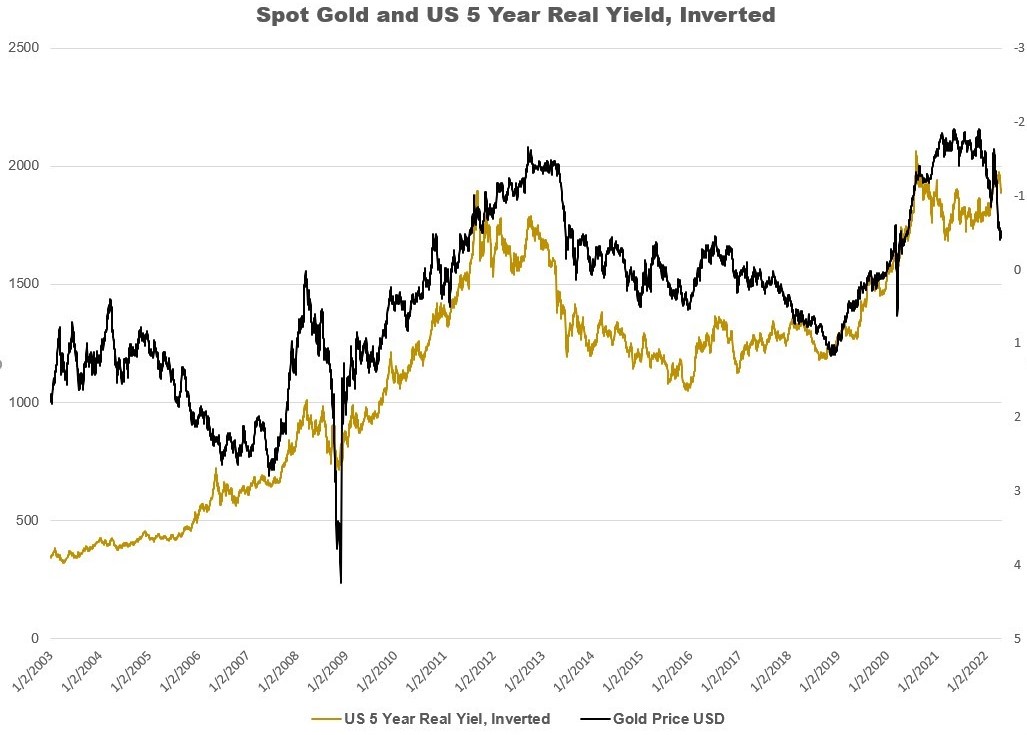

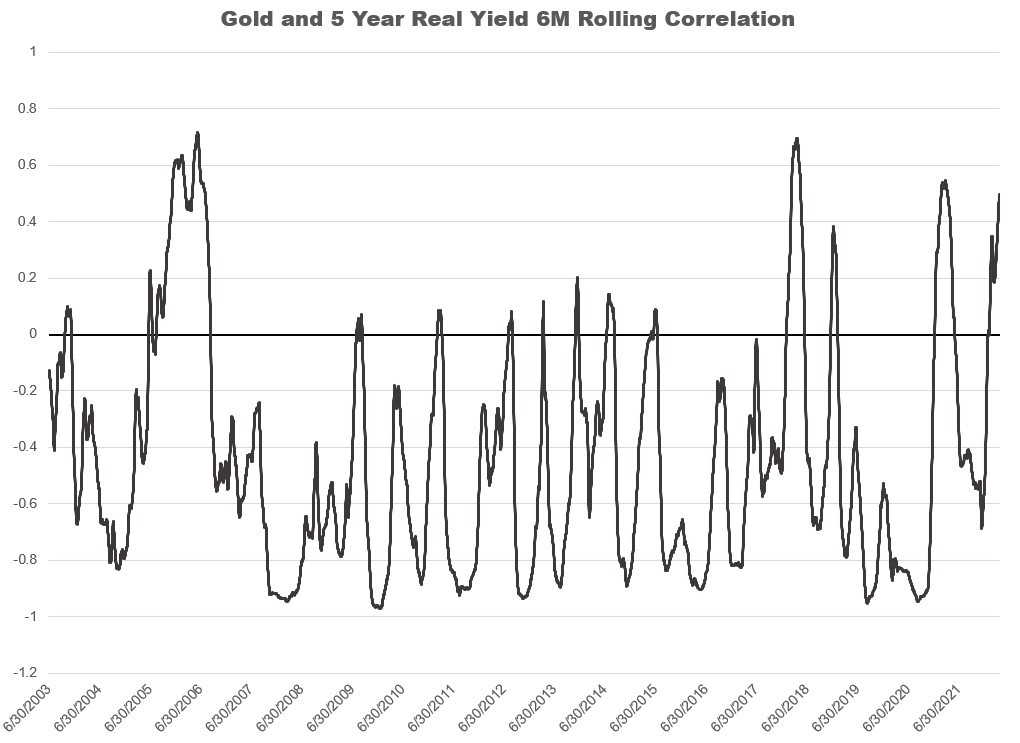

In terms of an indicator to watch, I think the historical relationship with US real yields could shift if gold becomes a neutral reserve asset. Most likely gold needs to re-rate higher in this scenario. I question how high US real yields can rise given the current debt to GDP, deficits and financialization of the economy. However, time will tell.

Disclosure

This report and the information contained herein is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. This information is for discussion purposes only. Nothing contained in this report constitutes tax nor legal advice. Alternative Investing is complex and speculative; and thus, […]

Streamlining Alternative Investments: A Conversation with GLASfunds CIO, Brett Hillard