Brett Hillard, CAIA, CFA & Huck Bethune

Increased Competition in Direct Lending: Navigating Private Credit Evergreen Funds for Alpha

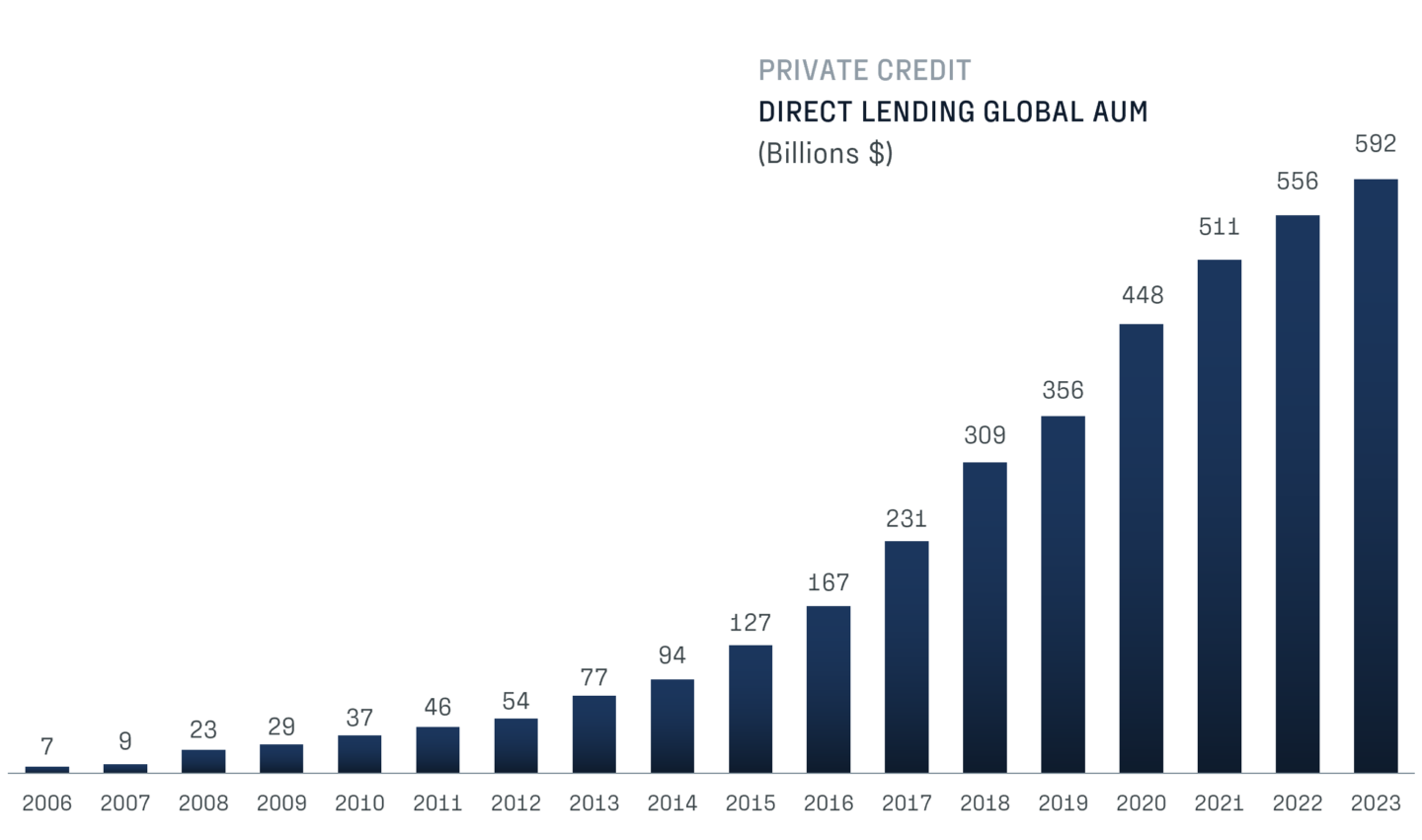

Private credit has experienced explosive growth in recent years, establishing itself as a core allocation in the portfolios of wealth managers, family offices, and registered investment advisors (RIAs) seeking alternatives to public fixed income. Traditionally the domain of institutional investors, private credit expanded to approximately $1.5 trillion at the start of 2024, up from $1 trillion in 2020, and is expected to soar to $2.6 trillion by 2029. The emergence of evergreen funds has further accelerated access to private credit, offering flexible, continuously available vehicles that bypass the rigid structures of traditional private credit funds. However, as direct lending strategies proliferate, allocators must critically assess whether they are capturing genuine alpha or merely paying excessive fees for repackaged credit market beta.

The Problem: Increasing Competition in Direct Lending

Direct lending was once a niche strategy that delivered outsized risk-adjusted returns, but its popularity has led to an increasingly competitive marketplace.

Large managers have raised direct lending evergreen funds in the tens of billions, aggressively deploying capital into middle-market and large corporate lending. With increased capital, loan spreads have compressed, covenants have loosened, and loans that have payment-in-kind structures have increased.

This influx of capital raises key concerns: are wealth managers truly accessing differentiated, high-quality investments, or are they simply participating in an expensive repackaged form of credit market beta? Some of the largest evergreen funds provide broad-based credit exposure without a discernable edge in origination, underwriting, structuring, or risk management, which could lead to lower risk-adjusted returns.

The effects of competition are particularly pronounced in the large part of the market where lines with the broadly syndicated loan (BSL) market continue to blur. Larger deal sizes can be attractive for managers that have raised large pools of evergreen capital which investors expect to be deployed quickly.

Allocators must critically assess whether these funds are truly generating alpha or merely offering an expensive version of leveraged loan market beta. Additionally, some funds can have a high degree of overlap with competing funds. Diversification needs to be assessed not only at the manager and fund level, but at the position level as well.

Furthermore, allocators should carefully examine the underlying drivers of AUM growth:

- Are these direct lending funds size a reflection of attractive market opportunities?

- Does the manager have the ability and incentive to slow deployment based on market conditions?

- How do the fees and costs compare to funds providing similar exposure?

With a high degree of overlap across evergreen direct lending funds, diversification needs to be assessed at the manager and fund level – as well as the position level.

Diversifying Beyond Direct Lending

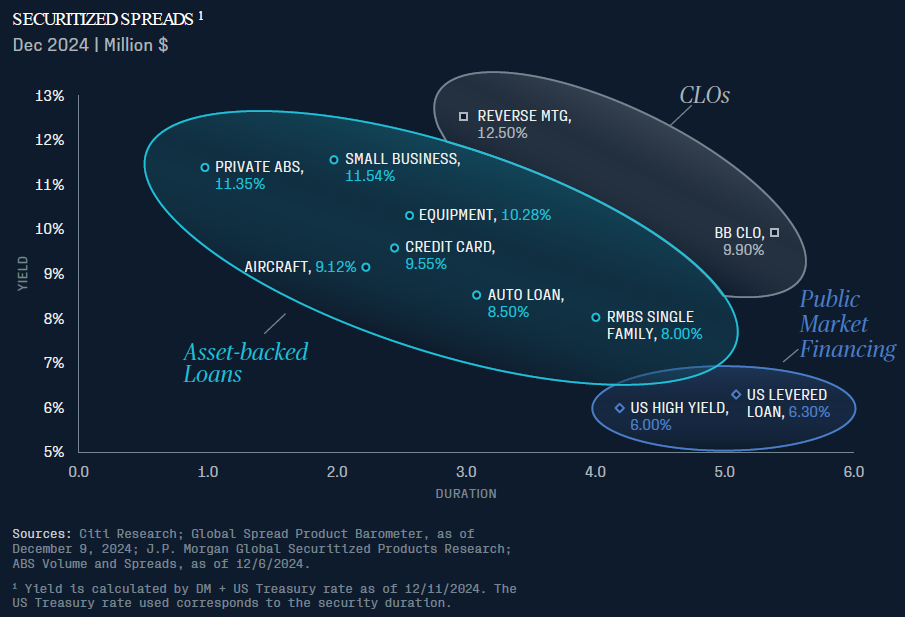

We believe wealth managers should diversify direct lending and explore alternative private credit strategies. Asset-based lending (ABL), for example, offers a compelling alternative with secured loans backed by tangible collateral such as receivables, inventory, or equipment. While it requires expertise in collateral valuation and enforcement, ABL can provide stability and protection in economic downturns.

Areas in securitized credit have favorable spreads compared to direct lending which has incurred steady spread compression since the first half of 2023. Additionally, securitized structures can have stronger collateral protection, documentation and self-liquidating features. The BSL market has incurred elevated levels of liability management exercises due to weaker loan documentation. While the direct lending market has been more immune, there are legitimate concerns aggressive borrower behavior could increase.

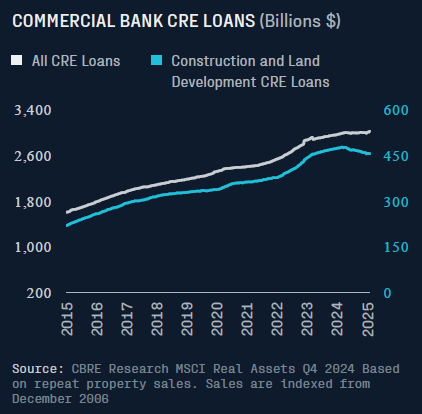

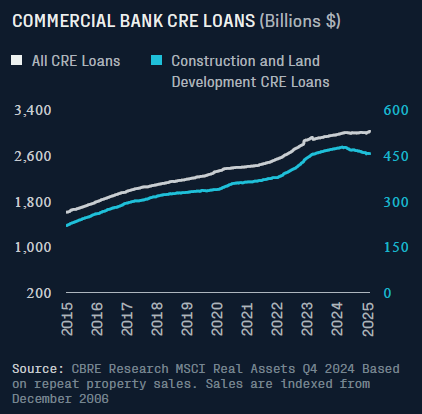

Real estate debt presents another opportunity, particularly for investors looking for inflation resistant income.

Some industries in the corporate credit market have been volatile due to mismatches in cost inflation and pricing power. Loans backed by commercial and residential real estate, particularly in senior positions can be resistant to inflation with underlying rent escalator. However, sponsor quality, valuation fluctuations and liquidity risks must be carefully considered. Underlying property values in certain sectors have declined materially since the peak in 2022. Loan-to-value ratios on newly originated loans are being made on more conservative valuations.

Experienced lenders can navigate challenging markets and take advantage of potentially more favorable loan pricing.

Our research indicates that banks are re-emphasizing commercial real estate lending after pulling back for several years. However, larger institutional lenders are focused on larger, high-quality first mortgages. Bank lending for more complex situations continues to decline, creating opportunities for adept alternative lenders.

Anchor Deals Proliferate

As discussed, one of the risks in private credit funds is cost drag—allocators paying high fees to strategies that could be incurring increasing levels of competition.

Many large funds charge 1.0%–1.5% management fees plus a performance fee that can range from 10% to 15% above a hurdle (typically 6% to 8%). Increasingly management fees are being assessed on NAV but some structures charge on invested capital. Assuming a management fee charged on invested capital, a fund with a debt-to-equity ratio of 1.0 has a management fee that is nearly twice as high as a fund that charges on NAV.

Wealth managers must critically assess whether a fund’s fee structure is justified by its alpha potential. Larger funds may incur pressures to deploy capital efficiently leading to higher allocations to syndications rather than directly arranging deals. One way to enhance net returns and better align costs with performance is by negotiating fee breaks or securing revenue / profit-sharing arrangements through seed deals, where early investors receive preferential economics. These structures can significantly mitigate the impact of high fees.

Recently, the availability of seed deals has surged, as fund managers actively seek to establish a scaled presence in wealth management channels. These deals can materially enhance returns, with observed IRR uplifts ranging from 100 to 500 basis points or more. Structures can vary but typically include a combination of fee discounts and revenue or profit shares. Anchor deals can also come with longer lock-up periods and higher minimums. With tighter dispersion in private credit and particularly sponsor-backed direct lending, anchor deals can increase the probability of achieving top-quartile returns. For wealth managers liquidity flexibility, anchor deals can be compelling away to enhance returns and lower risk. This is particularly attractive in sponsor-backed direct lending that is increasingly competitive.

Private Credit Evergreen Funds – Opportunities and Risks

The rapid expansion of private credit evergreen funds has created a paradox: while opportunities abound, the influx of capital into direct lending has potentially eroded alpha potential.

Wealth managers, family offices, and RIAs seeking meaningful returns must look across the private credit spectrum and focus on managers and funds with differentiated sourcing, disciplined underwriting, prudent deployment and compelling fee structures.

Our research indicates that there are attractive opportunities in asset-based lending and commercial real estate lending on a risk-adjusted basis. Additionally, these strategies are diversifying to sponsor-backed direct lending. Wealth managers should consider anchor deals to potentially enhance returns and lower risks if longer lock-ups are suitable. Allocators that cannot meet the higher minimums could consider aggregation platforms.

disclaimer

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply any specific level of skill or expertise. This information is intended solely for financial institutions and investment professionals and is not directed at individual consumers or retail investors unless explicitly noted.

The opinions expressed herein are for informational purposes only and should not be construed as specific advice or recommendations regarding any security or advisory service. The content is intended to provide educational insights about the financial industry. The views shared in this commentary are subject to change at any time without notice. Although all information presented, including that from external, linked, or independent sources, is believed to be reliable, we make no guarantee as to its accuracy or completeness. We reserve the right to modify these materials without notice and are under no obligation to provide updates.

This document may contain “forward-looking statements,” identifiable by terms such as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar expressions. Examples include, but are not limited to, projections about financial conditions, operational results, and the performance of investment strategies. These statements are subject to various risks and uncertainties, including, but not limited to, general and local economic conditions, changing competition within specific industries and markets, fluctuations in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory, and technological factors that could cause actual results to differ significantly from those projected.

This report is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. Nothing contained in this report constitutes any tax nor legal advice. This report is solely for the intended recipient, who has warranted qualifications to make sophisticated investment decisions. GLASfunds makes no representations or warranties regarding the methodology used for any investment performance calculations presented by any funds. Past performance is not indicative of future returns.