Camden Gerard, CAIA

Brett Hillard, CAIA, CFA

At the end of the day DPI = TVPI for private capital funds. Therefore, it is beneficial for LPs to monitor DPI generation over the course of a private capital fund’s life, while also comparing that performance to peers and historical funds within the same asset class.

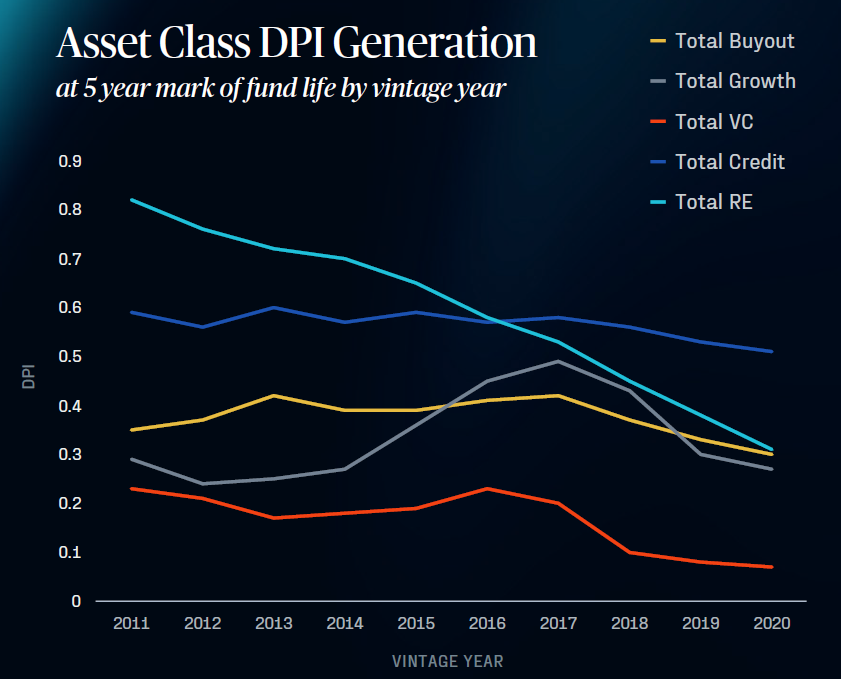

Utilizing data from Hamilton Lane, we analyzed DPI generation for multiple private capital asset classes by vintage year at specific points in the fund’s life. Overall, we have found that DPI generation for funds from more recent years has noticeably slowed down compared to funds from earlier vintage years.

Sources: Hamilton Lane, Cobalt

Specifically, we found managers’ median DPI at the five-year mark of the fund’s life has dropped notably from 2011 vintage funds to 2020 vintage funds. This theme was common across the asset classes of Buyout, Growth, Venture Capital, Credit, and Real Estate. Real estate had the largest drop in multiple of 0.51x followed by venture with a decrease of 0.16x. Credit, buyout, and growth DPI generation fell by 0.08x, 0.05x, and 0.02x respectively.

We believe that this slowdown in DPI generation over time can be attributed to multiple factors:

- Rapid growth of the private capital market, leading to increased competition.

- Expansion in fund sizes, creating challenges in deploying and exiting capital efficiently.

- Higher interest rates impacting valuations and exit opportunities.

- A decline in M&A and IPO activity, which traditionally served as primary liquidity events for private companies.

Earlier vintage funds benefited from a more favorable combination of fund sizes, M&A and IPO activity and a fast growing private capital ecosystem. In contrast, newer vintage funds face heightened challenges in generating liquidity. Investors may need to adjust tactics with private capital in a different growth stage.

Our takeaway from this data is that LPs should consider focusing on certain areas within private capital that have been able to consistently source exit opportunities and generate liquidity throughout different market cycles. Another feature that we view as attractive in a liquidity-constrained market is the ability to distribute income. A few strategies we have found to meet this criterion include:

Tail End Secondaries

Secondaries strategy focused on acquiring private equity interests in older funds that are typically at least 10 years old and have limited NAV outstanding compared to original commitments. We have found this area of the secondaries market to offer steeper discounts and less competition among many other positive attributes compared to traditional secondaries. Investors should focus on a manager’s ability to target assets with clear exit paths.

Focused Small Cap Buyout

Small cap buyout funds often exhibit agility in identifying and executing profitable exit opportunities and are less reliant on the IPO and M&A markets compared to larger cap funds. It is common for larger sponsors to acquire assets from small buyout funds. Additionally, their focus on niche markets and driving operational efficiencies can translate into more consistent value creation across market cycles.

Real Estate Debt

In markets where liquidity is constrained, real estate debt provides an income-generating investment option. Its emphasis on secure cash flows and stable returns can be appealing to LPs seeking consistent distributions while also providing downside protection.

Conclusion

The apparent slowdown in DPI generation across asset classes underscores the evolving challenges facing both private capital funds and investors. While recent vintages struggle to source efficient exit options, LPs can adapt by focusing on strategies that have a track record of generating more consistent distributions.

In our view, tail-end secondaries, small cap buyouts, and real estate debt stand out as compelling options for navigating liquidity-starved markets. As the private capital landscape continues to evolve, a nuanced approach to DPI generation analysis and strategy selection will be essential.

intended solely for financial institutions and investment professionals

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply any specific level of skill or expertise. This information is intended solely for financial institutions and investment professionals and is not directed at individual consumers or retail investors unless explicitly noted.

The opinions expressed herein are for informational purposes only and should not be construed as specific advice or recommendations regarding any security or advisory service. The content is intended to provide educational insights about the financial industry. The views shared in this commentary are subject to change at any time without notice. Although all information presented, including that from external, linked, or independent sources, is believed to be reliable, we make no guarantee as to its accuracy or completeness. We reserve the right to modify these materials without notice and are under no obligation to provide updates.

This document may contain “forward-looking statements,” identifiable by terms such as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar expressions. Examples include, but are not limited to, projections about financial conditions, operational results, and the performance of investment strategies. These statements are subject to various risks and uncertainties, including, but not limited to, general and local economic conditions, changing competition within specific industries and markets, fluctuations in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory, and technological factors that could cause actual results to differ significantly from those projected.

This report is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. Nothing contained in this report constitutes any tax nor legal advice. This report is solely for the intended recipient, who has warranted qualifications to make sophisticated investment decisions. GLASfunds makes no representations or warranties regarding the methodology used for any investment performance calculations presented by any funds. Past performance is not indicative of future returns.