“Institutional ESG investors reluctant to invest in long-term, capital intensive, blue-sky projects that at least have the chance to really move the needle towards reliable, cost-effective, sustainable energy”

In my experience many investors focused on ESG prioritize the E or environment more so than the S (social) or G (governance). While it’s not for me opine on what is “right” or “wrong” as I firmly believe in the freedom of choice. However, by emphasizing one aspect over the other and how that is implemented may have unintended consequences on the other areas.

“In particular, I believe energy and commodity divestment is sub-optimal and can inflict bad outcomes on more vulnerable populations”

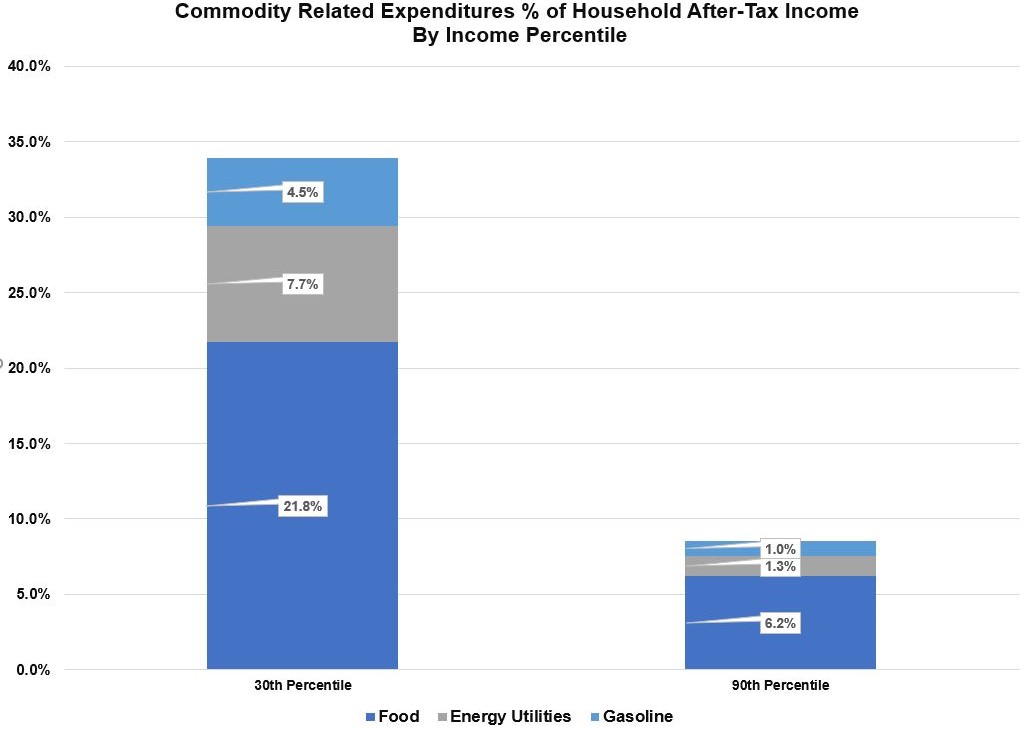

Class is a less common area of emphasis of investors focused on ESG. (Again this is purely an observation). By explicitly raising the cost of fossil fuels and therefore other commodities through divestment, lower income households bear the brunt of it. In other words, the S is forgotten. Lower income households skew female and non-Caucasian. There are also geopolitical consequences of foregoing energy independence as well which is front and center with the Russia-Ukraine issue today.

I have also found many institutional ESG investors reluctant to invest in long-term, capital intensive, blue-sky projects that at least have the chance to really move the needle towards reliable, cost-effective, sustainable energy. Instead venture dollars are plowed into capital light, internet based companies such as short-form video social media platforms and food-delivery platforms.

To be clear, I believe we need to continue to push to clean, sustainable energy but how we do that matters….a lot. I also applaud the many ESG investors who have good intentions and want to make a positive impact. However, we cannot forget to ask “who pays?”

When commodity prices rise, the lower income households pay a disproportionate share. Below is the percentage of after-tax household income that goes for food, energy related utilities and gasoline. These are from the BLS Consumer Expenditure Survey for 2020. I included the 90th percentile as many investment professionals that make divestment decisions are likely in this percentile or above.

Clearstead Expands Partnership with GLASfunds to Enhance its ClearAccess Private Markets Investment Platform

Disclosure

This report and the information contained herein is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. This information is for discussion purposes only. Nothing contained in this report constitutes tax nor legal advice. Alternative Investing is complex and speculative; and thus, […]