Brett Hillard, CAIA, CFA, Chief Investment Officer at GLASfunds

As on-again, off-again tariffs unsettle the economy, commercial real estate is certainly not immune to the impacts. However, those impacts present a mixed bag of opportunities and challenges for real estate investors.

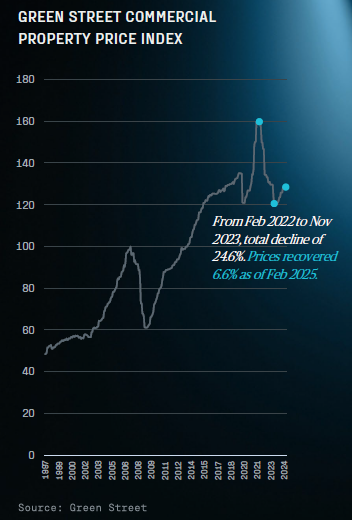

To set the stage, the commercial real estate market started to recover in 2024 after challenging years in 2022 and 2023. Property prices troughed at the end of 2023 and steadily increased in 2024. Simultaneously, capital availability for real estate transactions has increased, with banks and other capital providers loosening terms, albeit from previously tight levels.

Looking across commercial real estate, there is wide dispersion across sectors, with lower vacancy rates in data centers, industrial, and multi-family properties. On the opposite end of the spectrum, office vacancies remain historically high in the post-COVID, hybrid-work environment. However, the office market is bifurcated, with high vacancy largely attributed to office buildings built before 2015.

The potential impact of a tariff-induced recession on commercial real estate sectors

The possibility of a broad-based recession would largely be negative for real estate. However, a recession could trigger lower interest rates, which would be bullish for the asset class. That said, the potential impact of a recession on commercial real estate is highly dependent on the sector.

Historically, traditional office space has proven to be the most sensitive sector within real estate to recessions. That sensitivity has been magnified post COVID as rents and occupancy rates have declined materially because of remote and hybrid-work arrangements. But even with the fundamental reimagining of the office sector, it’s important to understand that not all office space is created equal. Currently, there is strong demand for high-quality space, and a recession would likely cause the greatest distress in older or Class B and below buildings (just 15% of office buildings account for about 70% of vacancies and are primarily older buildings).

Investors typically want to “swim upstream” in terms of quality, as property owners are better able to source loans that are backed by high-quality buildings with attractive tenants. That focus on the quality of tenants should not be overlooked by investors, especially how those tenants could be impacted by tariffs and governmental policies. For example, having the U.S. government as a tenant was very much a positive in the past … not so much anymore, at least for now.

That all said, certain types of properties, such as medical office buildings, would likely show more resilient demand in a recession given demographic trends.

Alternatively, multi-family housing could prove more resilient in a recession, especially workforce housing and student housing, given supply deficits in both areas.

The impact of a recession on industrial real estate development could be mixed given higher supply growth and economic sensitivity. However, continued onshoring could be a long-term demand driver.

And while the development of data centers has captured the attention of commercial real estate investors, if a recession causes large tech companies to re-think demand and capex plans, then the case for investing in data centers could be negatively impacted.

Weighing real estate credit versus equity opportunities

Given the relatively high level of interest rates, increased recession risks, and continued limited capital availability, we believe the current environment presents more opportunity for investors in real estate credit than real estate equity. However, there are some specific equity strategies that we view as advantageous.

Within real estate credit, strategies that offer unique access to deal flow, target high-quality real estate sponsors, and provide customized loan structures are particularly attractive.

Our review of multiple strategies indicates high-quality lenders can originate loans at low double-digit yields. This compares favorably to cap rates that are currently ranging from 6% (multi-family) to 9% (office), depending on sectors.

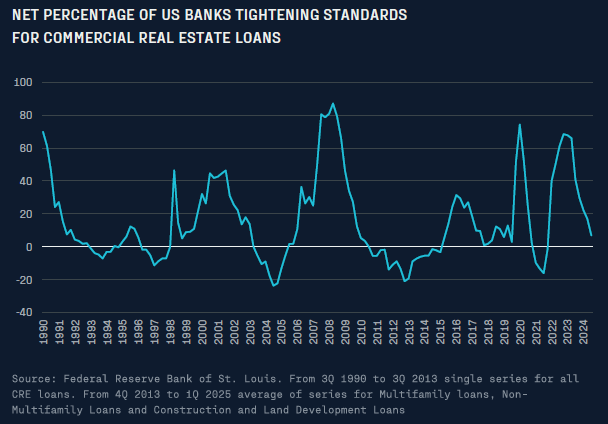

It is also worth noting that a risk environment like we are in now represents an opportunity for alternative lenders. Historically, U.S. banks pull back from commercial real estate lending during recessions.

Alternative lenders can get better access to deal flow and pricing during these periods. While banks have been starting to loosen lending practices, this could reverse during a recession. Additionally, banks have continued to shy away from more complex transactions, such as construction.

Within real estate equity, areas with favorable demand trends, such as workforce housing and purpose-built student housing, are positioned to better weather economic volatility. Multi-family has had the least recession sensitivity, based on changes in vacancy rates and rent growth, since 1981, based on recent analysis by Goldman Sachs.

Specifically, real estate development firms that are vertically integrated (firms that have internal design, construction, leasing, and property management capabilities) are better able to control costs, which are likely to increase with current tariff and immigration policies.

In the long-term, higher building material and labor costs could push up replacement costs and lower supply growth, which should serve as “tail winds” for commercial real estate values going forward.

disclaimer

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply any specific level of skill or expertise. This information is intended solely for financial institutions and investment professionals and is not directed at individual consumers or retail investors unless explicitly noted.

The opinions expressed herein are for informational purposes only and should not be construed as specific advice or recommendations regarding any security or advisory service. The content is intended to provide educational insights about the financial industry. The views shared in this commentary are subject to change at any time without notice. Although all information presented, including that from external, linked, or independent sources, is believed to be reliable, we make no guarantee as to its accuracy or completeness. We reserve the right to modify these materials without notice and are under no obligation to provide updates.

This document may contain “forward-looking statements,” identifiable by terms such as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar expressions. Examples include, but are not limited to, projections about financial conditions, operational results, and the performance of investment strategies. These statements are subject to various risks and uncertainties, including, but not limited to, general and local economic conditions, changing competition within specific industries and markets, fluctuations in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory, and technological factors that could cause actual results to differ significantly from those projected.

This report is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. Nothing contained in this report constitutes any tax nor legal advice. This report is solely for the intended recipient, who has warranted qualifications to make sophisticated investment decisions. GLASfunds makes no representations or warranties regarding the methodology used for any investment performance calculations presented by any funds. Past performance is not indicative of future returns.