Alternative investments have the potential to enhance returns, lower risks, and broaden diversification when added to a traditional portfolio of stocks, bonds, cash. Given the complexity and wide differentiation across alternative strategies, investors and allocators may require dedicated sourcing and diligence capabilities. Allocating to alternatives can also be operationally complex.

Brett Hillard

Alternative investments have the potential to enhance returns, lower risks, and broaden diversification when added to a traditional portfolio of stocks, bonds, cash. Given the complexity and wide differentiation across alternative strategies, investors and allocators may require dedicated sourcing and diligence capabilities. Allocating to alternatives can also be operationally complex.

Why Invest in Alternatives?

Investors primarily allocate to alternatives with the objective to enhance returns and/or lower risk through greater diversification. In some instances, investors may target alternatives to achieve certain ESG goals. While there are always exceptions, hedge funds and real assets are generally viewed as diversifiers and private capital as return enhancers.

Defining Alternative Assets

Before diving deeper into the potential benefits and considerations of alternatives, it’s important to define exactly what is meant by “alternatives.” Alternatives refer to asset classes and strategies that are not classified as liquid stocks, bonds, or cash. Common alternative strategies include hedge funds, private capital, and real assets.

The Power of Choice in Maximizing Portfolio Efficiency

Core tenants of any investment program, whether for individuals, institutions, or pensions, include trying to maximize returns given an investor-specific risk profile, while also considering constraints. These can include liquidity needs, tax efficiency, income sources, preferences such as environmental, social and governance (ESG) issues and other factors.

While “optimal” portfolios in terms of maximizing returns per unit of risk are largely theoretical, striving to increase portfolio efficiency towards optimal is a valuable pursuit. To increase the expected return per unit of risk, investors should start with the most expansive opportunity set possible. Assuming there are not extreme imbalances in certain assets, constraining the investment universe will lower expected returns on an ex-ante basis.

More simply, investors with fewer choices have less of an opportunity to craft more efficient portfolios. Does this mean constrained investors will automatically underperform? No! Forecasting is challenging, and segments of investors that constrain themselves to certain areas of the market may benefit if specific circumstances that benefit the selected assets transpire.

Forecasting: Beyond the 60.40 Portfolio

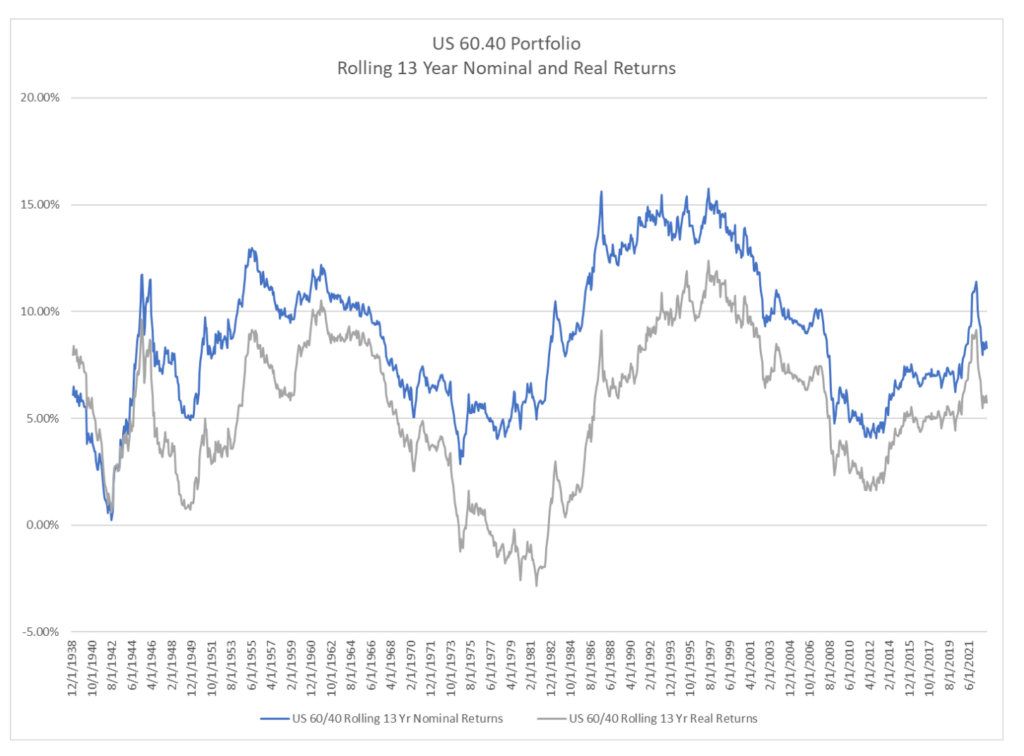

The period from 2009 to 2021 was especially profitable for investors that solely focused on US large cap stocks and US investment grade bonds. From the beginning of 2009 to the end of 2021, a portfolio comprised of 60% US large cap stocks and 40% US investment grade bonds (60.40 portfolio) returned 10.9% per annum and 8.7% per annum after inflation.

The period from 2009 to 2021 was lucrative to holders of a US 60.40 portfolio compared to history. Only during the late 1950’s and the 1990’s were returns higher. During these periods of high returns for stocks and bonds, diversifying either geographically or into other asset classes likely contributed to lower returns. However, investors must approach investing looking through a windshield and not a rear-view mirror. As Sir Arthur Conan Doyle wrote in the Complete Sherlock Holmes, “It is easy to be wise after the event.”

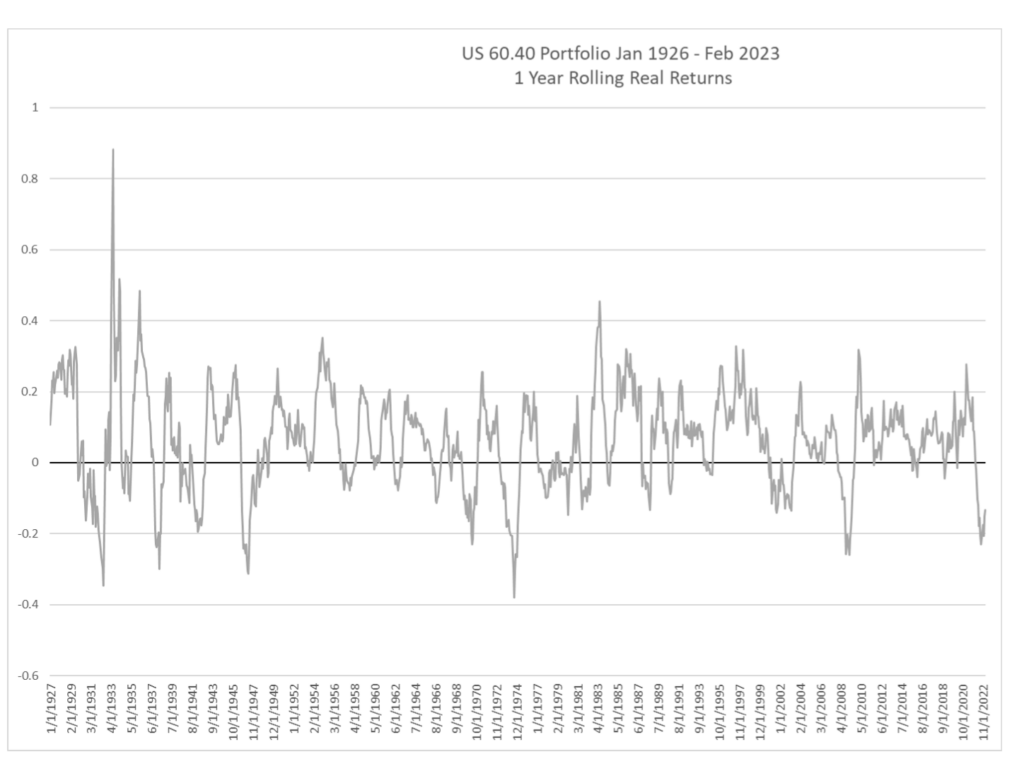

While one year does not make a trend, 2022 was a reminder of the benefits of diversification, as a US 60.40 portfolio declined 20.7% after inflation. Periods with similar or worse returns, occured in 2008, 1974, 1947, 1938 and from 1930 to 1932, were driven by steeper declines in equities. Financial assets such as stocks and bonds typically perform well during periods of moderate growth and low and stable inflation. In 2022, inflation broke out to 40-year high, leading to a sharp increase in interest rates and thus lower bond prices. Stocks sold off largely due to higher rates compressing multiples. However, real asset strategies, private credit, and certain hedge fund strategies such as global macro, trend-following and relative value multi-strategy generated strong returns in 2022. These strategies perform well in inflationary environments with higher volatility.

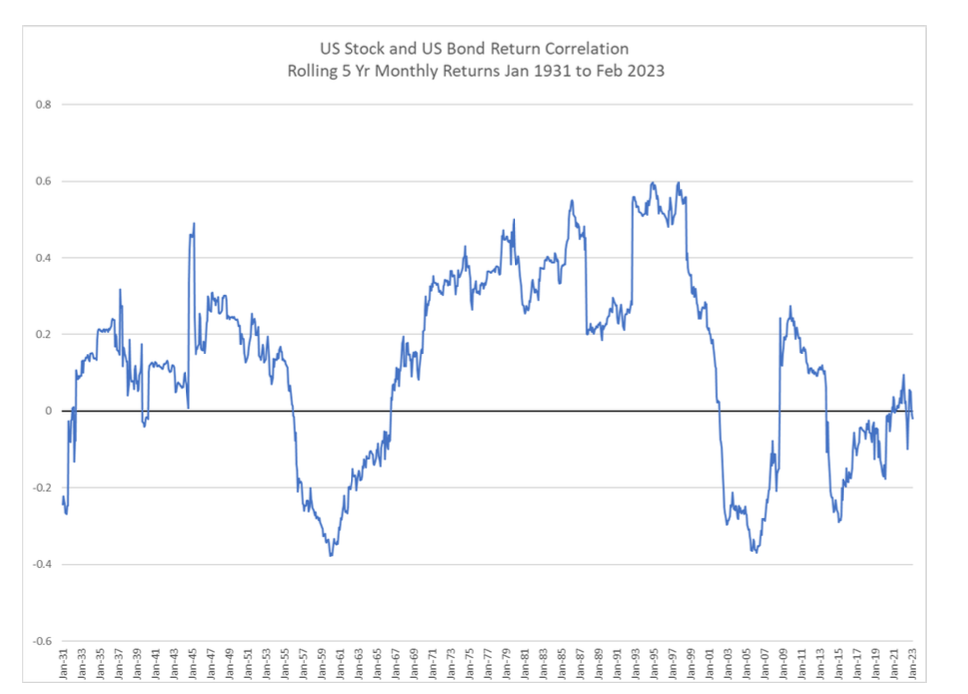

The diversification benefit between bonds and stocks has varied materially over time. This can be measured by rolling correlations. The 5-year rolling correlations of monthly stock and bond returns have ranged from nearly -0.4 (high diversification benefits) to 0.6 (lower diversification benefits).

Since 1931, the 5- year correlations of stock and bond returns have largely been positive. There has been two notable periods of negative correlations: from 1956-1966 and from 2002 to present. The 5-year correlation has never been negative when annualized inflation was 4% or higher over the same 5-year period. Given the difficulty of predicting correlations between stocks and bonds, investors may be better served by diversifying broadly. Ideally, portfolios should have exposure to a wide range of factors and return drivers while maintaining suitable risk.

Alternative Investments: Unlocking Access to a Suite of Return Drivers

Quantitative analysis is not ideal for measuring enhanced diversification for specific alternative strategies, particularly private capital and private oriented real assets. Quantitative analysis that includes public asset classes and private capital relies on combining liquid assets that are priced by the market, and illiquid assets that are dependent on appraisal values. Appraisals typically lag public markets and have smoother returns compared to liquid assets. These factors lead to lower volatilities and correlations. Therefore, quantitative measures of risk can be understated. However, the qualitative case for diversification benefits is just as compelling. Alternative investments provide exposure to a broad array of return drivers that are not easily accessible in public markets:

Venture Capital

Venture capital focuses on innovative start-up companies creating new products or services that can lead to new markets and increased productivity. Given the high-risk and longer-investment horizon, start-up funding mostly occurs through private funds. Venture-funded companies may have an outsized impact on overall economic and employment growth. A 2019 study by the Centre for Economic Policy Research paper estimates that the US venture ecosystem may contribute up to 28% of overall US economic growth. If this estimate has a degree of accuracy, then public markets may be under-indexed to economic growth.

Private Equity

An increasing portion of the US economy and US corporate profitability is generated by private companies. Based on World Bank and Mckinsey data, the number of public companies has fallen from about 8,000 in 1996 to 4,000 in 2021. US buyout fund AUM at nearly $2.5 trillion is about 6.2% the size of US public companies at $40.5 trillion. The size of US buyout AUM as proportion of US market cap has steadily increased the past 10 years. Global private debt AUM is estimated at $1.2 trillion and has taken considerable share from public debt markets and banks.

Hedge Fund Strategies

Hedge fund strategies can generate returns in various market conditions through numerous techniques such as shorting, trade structuring, utilizing derivatives, and others. Strategies such as global macro and systematic trend-following typically benefit when volatility expands in traditional markets, such as stocks and bonds. Relative value managers can isolate portfolio exposure to capture the difference in returns vs. long positions and short positions. These return drivers can be highly diversifying to traditional portfolios.

Real Assets

Real assets can diversify financial assets such as stocks and bonds during inflationary environments. When inflation broke out in 2021 and 2022, certain real estate sectors, including residential and industrial, directly benefited from high rent growth. A primary contributor to the increase in US inflation has been higher shelter costs, which are derived from rents. Real estate managers that held residential assets in favored markets were able to increase rents by over 15% per year for nearly two years in a row. This was especially accretive to properties that were partially financed with fixed rate debt.

Addressing the Alternatives Gap Between Institutions and Individuals

Expanding the opportunity set is sensible to create more efficient portfolios across various regimes. However, alternatives are more prevalent in institutional portfolios compared to portfolios of wealthy individuals. This can likely be explained by the differences in experience with alternatives, access, administrative complexities, scalability, holding period differences, perceptions on liquidity, and tax efficiency.

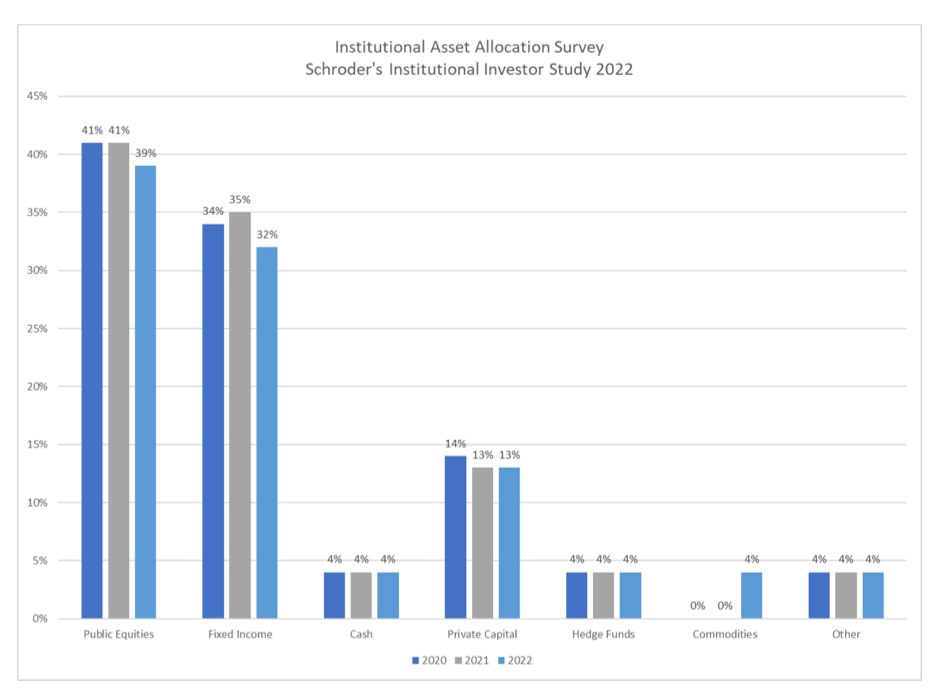

Schroders, a UK based investment management firm, conducts an annual survey of global institutions. In 2022, institutions responded that in aggregate, the allocation to alternatives was nearly 21%, with over half of alternatives allocation to private capital or 13% of the total allocation. Survey data from multiple firms indicated that alternatives account for a materially smaller portion of wealth portfolios. Best estimates indicate alternatives account for about 6% to 9% of wealth management portfolios, with private capital accounting for a material portion of the alternatives allocation.

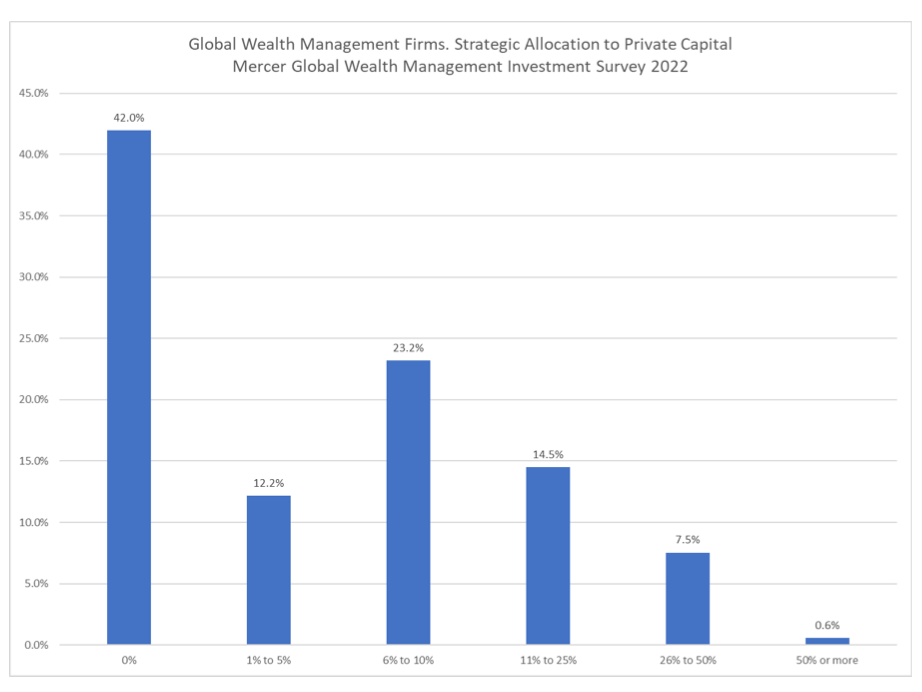

A 2022 survey of 125 global wealth managers by Mercer indicated that 58% of responding firms currently invested in private capital, with an additional 15% indicating they were planning on allocating for the first time in the next 12 months.

Of the 42% of respondents that do not currently allocate to private capital, 71% cited that the lock-up periods were too long, while 59% indicated a lack of resources to perform the required due diligence. Private capital remains an area of emphasis, with 68% of respondents intending to increase allocations over the next five years. The top two reasons for emphasizing alternatives provided by respondents were return enhancement and diversification.

Lowering the Barriers to Alternatives Access

Alternatives have the potential to enhance returns and improve diversification when added to traditional portfolios. Trends indicate that allocators will continue to increase allocations to alternatives in wealth management portfolios.

But understanding the “why” behind investing in alternatives isn’t enough to close the gap to institutional portfolios. Implementing alternatives at scale has been prohibitively complex and resource intensive. GLASfunds was founded to address these challenges, and provides a number of efficiencies and tools, as well as thorough due diligence and research, to enable wealth managers to more easily implement or amplify robust alternatives programs.

To learn more about how GLASfunds makes alternative investing streamlined yet customizable for both HNW and institutional investors by creating a single alternative investment platform that brings together access, technology, sourcing, and reporting, click here.

SOURCES

(1) Asness, C. (2017, May 18). Virtue is its Own Reward Or One Mans Ceiling is Another Mans Floor. AQR Insights

(2) US Stocks measured by S&P 500 TR. US Bonds measured by Morningstar’s “Stocks, Bonds, Bills and Inflation” data for US LT Govt TR USD from Jan 1926 to Dec 1975. Bloomberg US Agg Total Return Value Unhedged USD used from Jan 1976 to Feb 2023. Data accessed from Bloomberg, Morningstar Direct, and Venn by Two Sigma.

(3) World Bank Data: https://data.worldbank.org/indicator/CM.MKT.LDOM.NO?locations=US. Mckinsey Data: Vartika, G., Koller, T., Stumpner, P. (2021, October 2021) Reports of corporates’ demise have been greatly exaggerated. McKinsey & Company: Our Insights

(4) PitchBook. 2022 Annual US PE Breakdown

(5) Siblis Research https://siblisresearch.com/data/us-stock-market-value/#:~:text=The%20total%20market%20capitalization%20of,about%20OTC%20markets%20from%20here.

(6) Pitchbook. 2022 Annual Global Private Debt Report

(7) Schroders. Private Assets Institutional Investor Study 2022.

(8) Mercer. New sources of value in managing wealth. Findings from the 2022 Global Wealth Management Investment Survey. September 2022.

DISCLAIMER

This report and the information contained herein is not intended to be, nor should it be construed as, an invitation, inducement, offer or solicitation to engage in any investment activity. This information is for discussion purposes only. Nothing contained in this report constitutes tax nor legal advice. Alternative Investing is complex and speculative; and thus, not suitable for all investors. Such investment vehicles contain a high degree of risk and therefore no assurance may be made that any alternative investment objectives will be attained nor that investors will receive return of capital.

This report is an opinion only; it is not to be relied upon as the basis for an investment. Any data and firm information shown are for illustrative purposes. The information in this report has been provided to GLASfunds, including its employees, by sources determined to be reliable in providing such information. Therefore, GLASfunds has not, and is unable to, independently review, prepare, or verify information contained herein; further, GLASfunds makes no representation or warranty regarding the accuracy of the information provided to GLASfunds.Past performance is not indicative of future returns.

GLASfunds, LLC is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.

Understanding General Partner (GP) Stakes Investing

Exploring Private Capital and its Role in Portfolios

A Guide to Secondaries Funds: The Rise of Secondaries Funds As a Compelling Private Portfolio Allocation

Background on the Secondaries Market It’s well known that private capital investment opportunities are long-term investments that are highly illiquid. In other words, it can take multiple years to receive material liquidity from private capital funds, and it may take over 10 years for a fund to fully liquidate. For investors that demand liquidity, it’s […]